Risks of Buy Now Pay Later: BNPL & Your Credit File

Introduction

In recent years, the emergence of “buy now, pay later” (BNPL) services has transformed the way consumers make purchases. These services allow shoppers to split their payments into smaller, interest-free installments, making it easier to afford their desired products. While BNPL may seem convenient and tempting, it is crucial to be aware of the potential risks of buy now pay later services, particularly their impact on your credit score. In this blog post, we will explore the dangers of using BNPL and how they can affect your creditworthiness.

Increased Debt Accumulation

One of the significant risks of Buy Now Pay Later services is the potential for increased debt accumulation. The allure of splitting payments into smaller amounts can make purchases seem more affordable and tempting. However, these smaller installments can add up quickly, leading to higher overall debt if not managed carefully. Accumulating excessive debt can strain your finances, making it challenging to meet other financial obligations and potentially damaging your credit score.

Late or Missed Payments

BNPL services typically require you to make regular payments within specific deadlines. If you fail to make these payments on time or miss them altogether, it can have detrimental effects on your credit score. Late or missed payments can be reported to credit bureaus, resulting in negative marks on your credit history. These negative marks can stay on your credit report for several years, making it harder for you to obtain favorable credit terms in the future.

Negative Impact on Credit Utilization Ratio

Your credit utilization ratio plays a crucial role in determining your credit score. It represents the amount of credit you are currently using compared to your total available credit. Utilizing a large percentage of your available credit can indicate financial instability and increase the risk of default. Using BNPL services, especially if you have multiple active agreements, can contribute to higher credit utilization ratios, potentially lowering your credit score.

Limited Credit Options

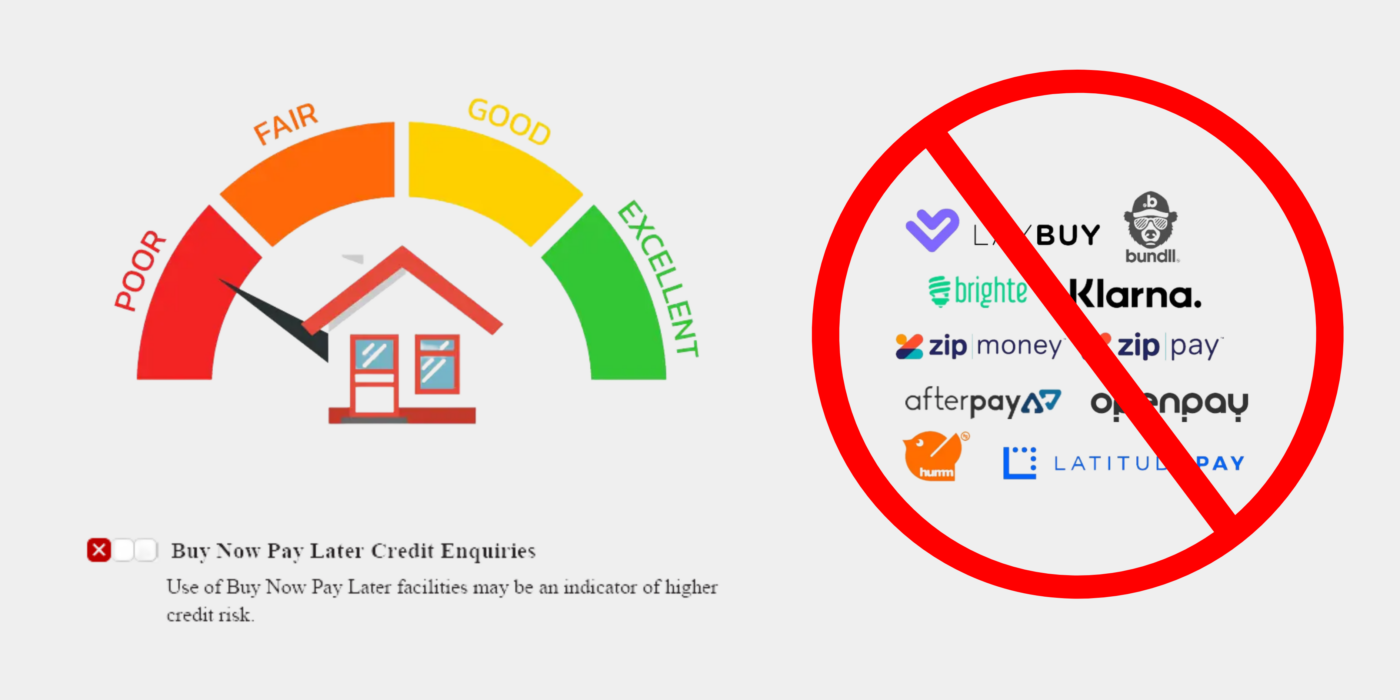

Repeatedly using BNPL services can impact your creditworthiness in the long run. Lenders and financial institutions evaluate your credit history when assessing your creditworthiness for future loans, mortgages, or credit cards. If they notice a pattern of relying heavily on BNPL services, they may view you as a risky borrower. This perception can limit your access to credit options or result in higher interest rates when you need them.

Impact on Credit Mix and Duration

Credit mix and duration are additional factors that influence your credit score. A healthy credit mix demonstrates your ability to handle various types of credit responsibly, such as credit cards, loans, and mortgages. Utilizing BNPL services alone may not provide a diverse credit mix, potentially affecting your credit score. Moreover, if you frequently open and close BNPL agreements, it can negatively impact the average age of your credit accounts, another factor considered by lenders and credit scoring models.

Conclusion

While buy now, pay later services can offer convenience and flexibility in managing your purchases, it is crucial to understand the potential risks involved, especially in relation to your credit score. Excessive debt accumulation, late or missed payments, negative credit utilization ratios, limited credit options, and impacts on credit mix and duration are factors that can significantly affect your creditworthiness. It is essential to use BNPL services responsibly, ensuring you can make timely payments and maintain a healthy overall credit profile. Remember, managing your credit wisely is key to your long-term financial well-being. If you would like to discuss how to get finance the right way contact Electric Loans today.